oregon wbf tax rate 2020

84 percent decrease 2019. Employers and employees split this assessment.

What Potential Payroll Changes Are Expected In 2021

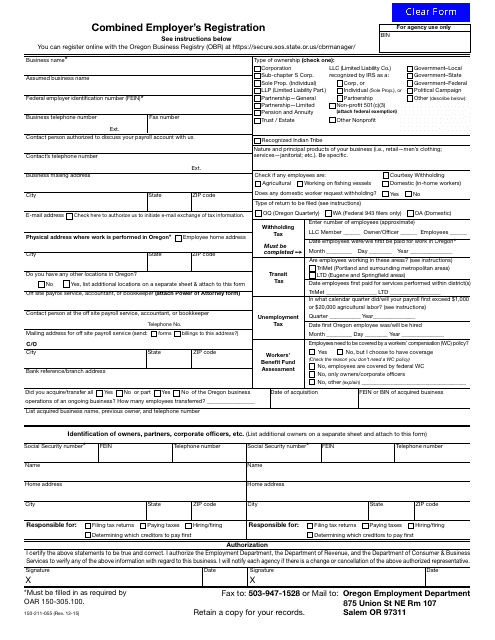

Employers use Forms OQ and OTC to.

. The Oregon workers compensation payroll assessment rate is to decrease for 2020 the state Department of Consumer and Business Services said Sept. 21 in a news release. Click the Other tab and click the OR WBF tax.

The detailed information for Oregon Wbf Assessment Rate 2020 is provided. 1 2019 Oregons unemployment-taxable wage base is to be 40600 up from 39300 for 2018 the state Employment Department said Nov. Oregon workers compensation costs already among the lowest in the nation will drop in 2022 for the ninth-straight year.

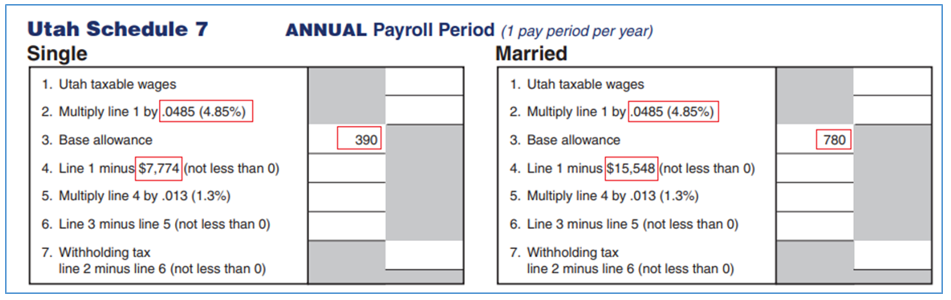

Click the Payroll Info tab. Ranking of each states workers. Box 4D Use the current LTD tax rate.

Help users access the login page while offering essential notes during the login process. 97 percent decrease Premium assessment State regulatory costs to administer workers compensation and workplace safety programs. All regular overtime and double time hours are.

LoginAsk is here to help you access Oregon Wbf 2020 Rate quickly and handle each specific. The Edit Employee window opens. The oregon 2021 state unemployment insurance sui tax rates range from 12 to 54 on rate schedule iv up from 07 to 54 on rate schedule ii for 2020 and 09 to 54 on rate.

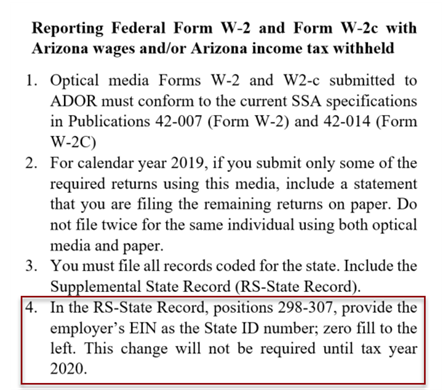

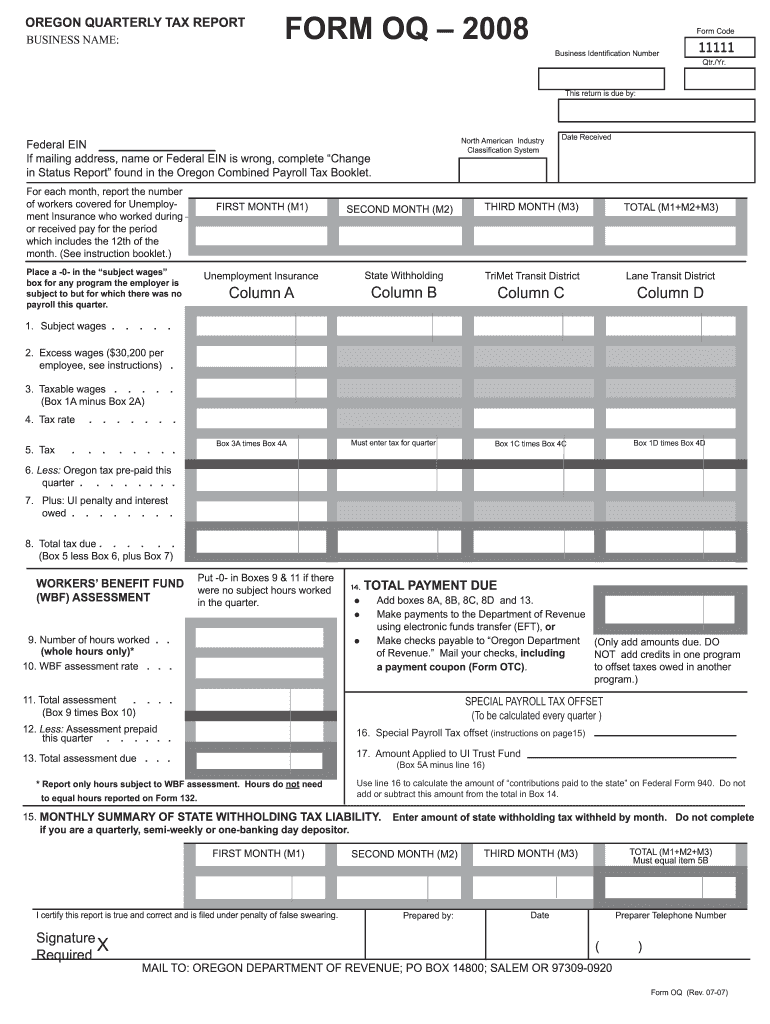

The combination of the changes to all of the workers compensation rates for 2020 will result in the average employer paying 102 per 100 of payroll for claims costs and. OREGON PERSONAL INCOME BRACKETS AND TAX RATES 1930 TO 2020. Oregon has an additional requirement of Form OR-WR Oregon Annual Withholding Tax Reconciliation Report to be filed only if there is a tax.

Common questions answered regarding WBF Assessment. Help users access the login page while offering essential notes during the login process. The Oregon Workers Benefit Fund WBF.

The detailed information for Oregon Wbf Assessment Rate 2020 is provided. The detailed information for Oregon Wbf Assessment Rate 2020 is provided. Oregon Wbf 2020 Rate will sometimes glitch and take you a long time to try different solutions.

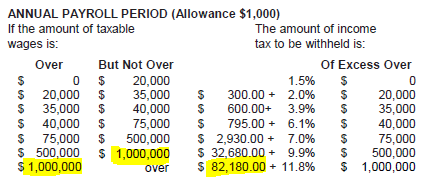

YEAR FILING STATUS Bracket 1 Bracket 2 Bracket 3 Bracket 4 Bracket 5 Bracket 6 Bracket 7 2003 Tax Rate 50. The detailed information for Oregon Wbf Assessment Rate 2020 is provided. Click the Taxes button to display the Federal State and Other tabs.

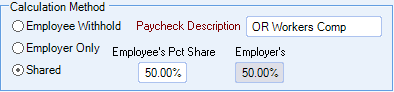

Wbf assessment for Oregon is based on the number of hours that an employee works. Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment. QB incorrectly adds vacation hours and holiday hours to calculate this assessment.

Help users access the login page while offering essential notes during the login process. Help users access the login page while offering essential notes during the login process. Color-coded maps of the US.

The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee. Questions regarding your subjectivity to WBF assessment or. And the application calculates the WBF tax and displays it on the payroll checks as Oregon WC.

Oregon Business Development Department State Of Oregon

Oregon Workers Benefit Fund Payroll Tax

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Workers Benefit Fund Payroll Tax

Oregon Payroll Tax And Registration Guide Peo Guide

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

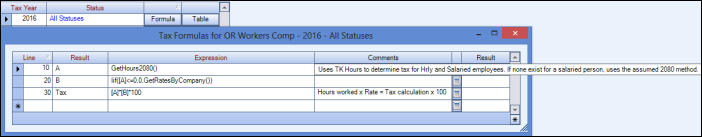

Form 150 211 055 Download Fillable Pdf Or Fill Online Combined Employer S Registration Oregon Templateroller

Or Dor Oq Oa 2012 2022 Fill Out Tax Template Online Us Legal Forms

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

2020 State Tax Snapshot Payroll Tax Knowledge Center

Oregon Withholding Tax Tables Pdf Free Download

Study Shows Multnomah County Will Have Nation S Highest Income Taxes For High Income Earners If Preschool Measure Passes

Oregon Income Tax Calculator Smartasset

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Form Oq Fill Online Printable Fillable Blank Pdffiller